How can investors make money through the shared power bank business?

Smartphones have become a necessity in people’s daily lives, covering every aspect from social entertainment, mobile payments, and work communication to travel navigation. As mobile phone functions continue to grow and usage frequency increases, “battery anxiety” has become a global issue. Mobile phone charging stations provide users with on-the-go charging solutions anytime, anywhere, while also offering investors a business opportunity with huge potential.

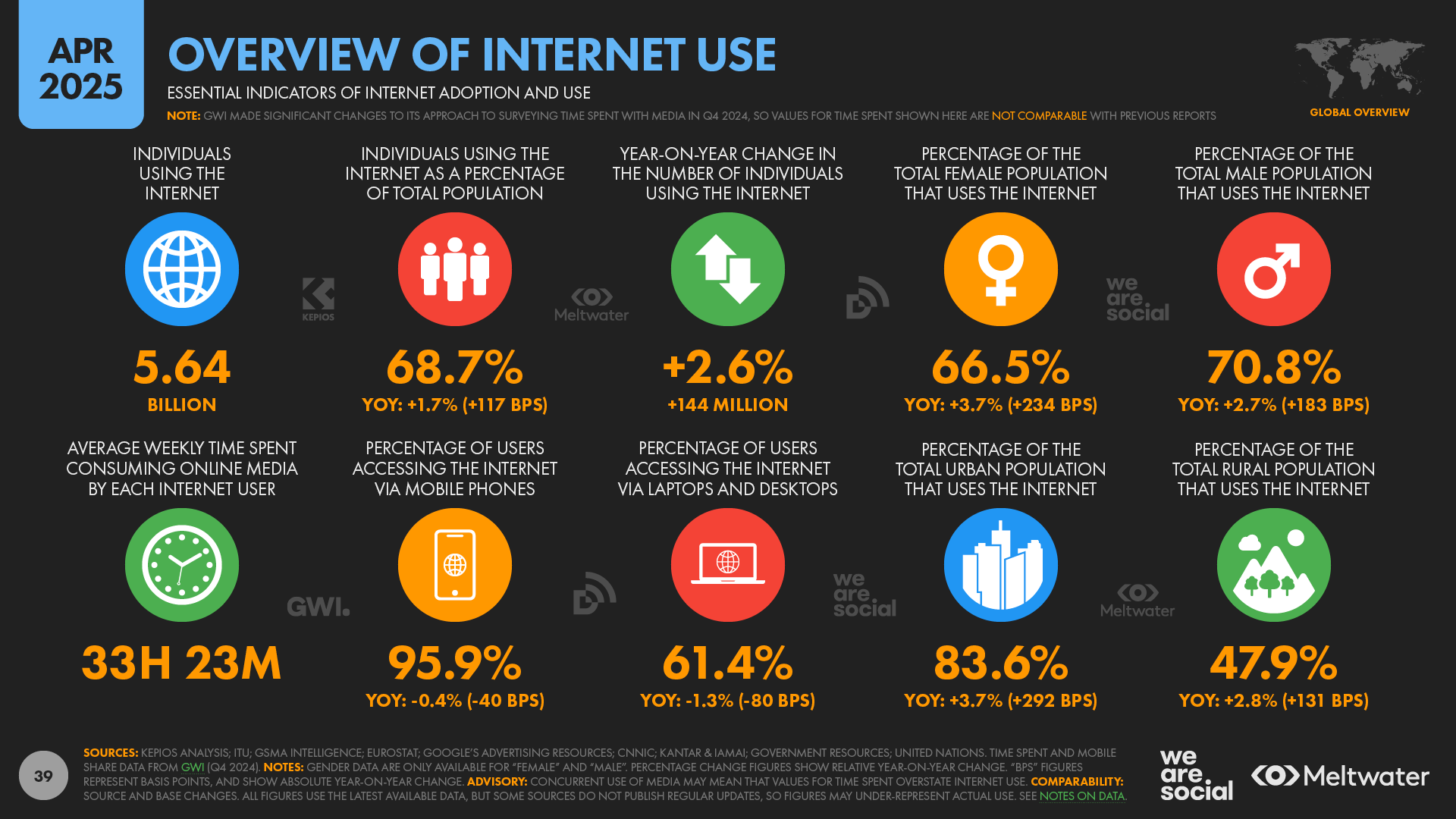

According to the latest data from Meltwater, the number of global internet users in 2025 will reach 5.64 billion. Each internet user spends an average of 33 hours and 23 minutes per week using online media, and 95.9% of them access the internet through mobile phones. People’s daily life, work, and entertainment all rely heavily on smartphones. The limited battery life of mobile phones has made battery anxiety a common phenomenon. The global shared power bank market has rapidly developed as a result of users’ increasing dependence on mobile devices.

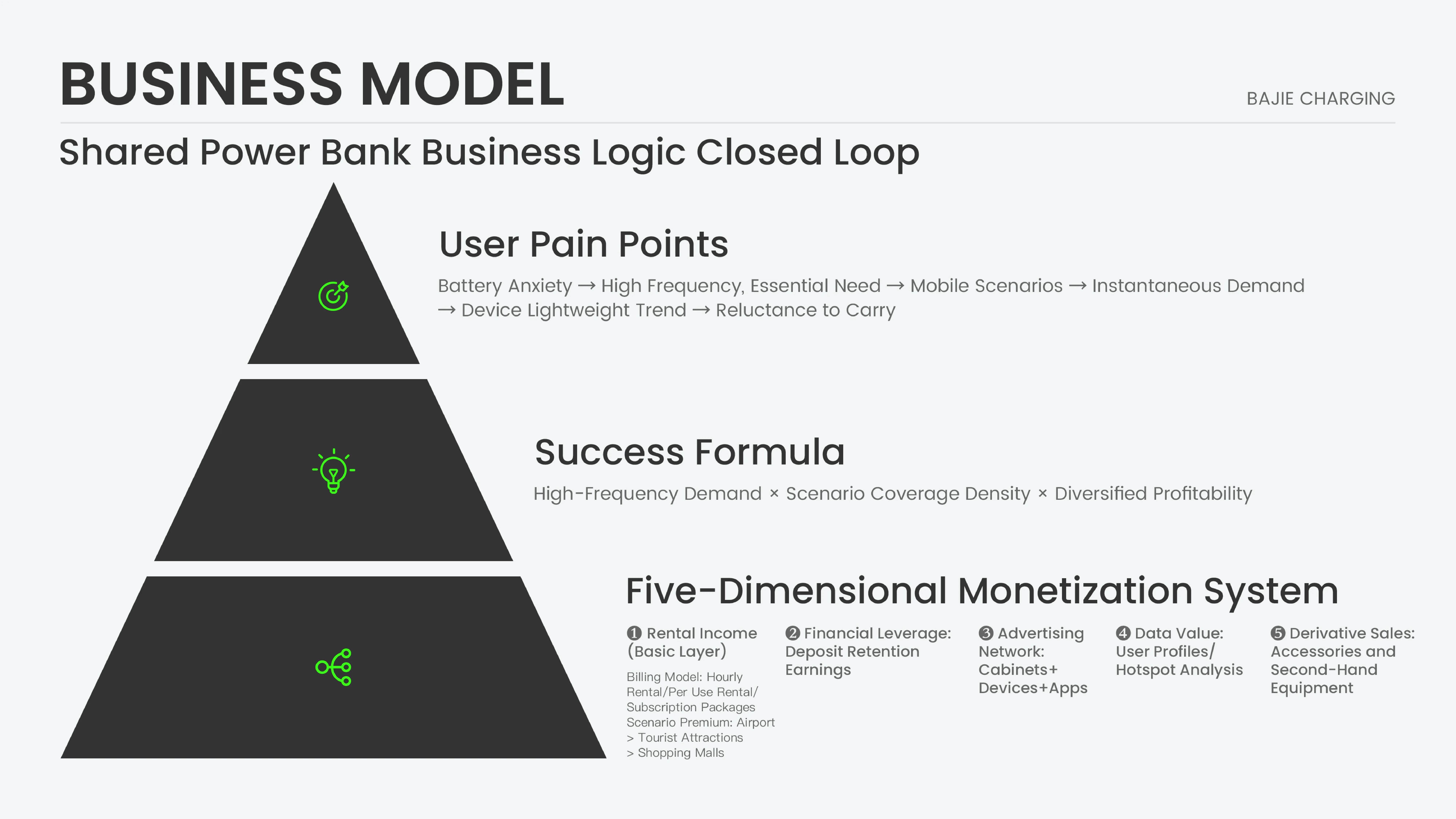

Power bank vending machines are widely deployed in shopping malls, airports, and other public areas, providing users with convenient and instant charging services. Phone charging stations generate comprehensive returns for investors through a diversified business model that includes rental, advertising, value-added services, data, and sales. As a business model that has already been proven in global markets, cell phone charging stations attract investors around the world with advantages such as economies of scale and quick return on investment, encouraging them to join the power bank station business.

1. How do the multiple revenue models of phone charging stations ensure more secure returns for investors?

The main source of income for sharing power bank rental stations comes from rental fees paid by users. Although the charge per rental is relatively low, mobile phone power banks cover numerous high-traffic locations, and frequent usage brings considerable rental income to investors.

Rental fees are usually calculated based on usage time, frequency, or package plans. Time-based pricing typically charges by the hour or half-hour. Different scenarios (restaurants, shopping malls, transportation hubs, etc.) may adopt different pricing strategies. During peak demand periods such as weekends, holidays, or special events, flexible pricing can be applied to increase revenue.

The screen or app of shared charging stations can display brand advertisements, creating advertising income for investors. The phone charging station platform can also utilize data such as user rental frequency, usage scenarios, and duration of stay to enable partner brands to achieve more precise ad targeting, improving both ad effectiveness and revenue.

Deposits collected from users create temporary capital accumulation. During the rental period, investors can utilize these funds for short-term investments or operational turnover. The current industry trend of “deposit-free” rentals replaces traditional deposits with credit evaluation, helping improve user conversion rates and lower entry barriers. In overseas markets involving multiple currencies, pre-authorization is widely adopted as the primary settlement method.

Value-added service income mainly comes from in-app services and brand collaborations. By offering coupons, memberships, and local lifestyle information within the app, investors can enhance user engagement and activity, generating additional income. Collaboration with local businesses such as restaurants and transportation services helps expand diversified revenue channels.

The vending machine power bank’s intelligent management system can transform user behavior data into business insights. By providing traffic analysis, accurate user profiling, and customized data services, it empowers partner brands and creates additional service income.

Through the sale of branded accessories, recycling and refurbishing old devices for resale, a “sales–recycle–resales” circular business model is formed, achieving diversified income and sustainable resource utilization.

Shared power bank stations achieve profitability through multiple revenue channels such as rental income, advertising income, deposits, value-added services, and product sales. This diversified structure reduces dependence on a single income source, enhances the resilience of the power bank rental kiosk business, and ensures more stable returns for investors.

2. Why do investors choose to invest in the cell phone charging locker business?

Power bank rental stations accurately meet users’ urgent charging needs by deploying devices densely in core consumption areas such as dining, entertainment, and transportation, providing users with convenient and instant charging services. The commercial charging station business model is clear: through widespread deployment, it creates economies of scale, generating continuous cash flow from rental and advertising income. The shared power bank has a relatively short payback period, low marginal cost in later stages, and strong profit growth potential, offering investors substantial return potential.

Quick returns: Through multiple income channels such as rental fees and value-added services, shared power bank businesses at premium locations usually recover their initial investment within 3–6 months, achieving a short investment cycle and high capital turnover efficiency.

Proven model: The business model has been validated globally. Bajie Charging has more than 500 successful operational cases, proving the universality and sustainability of the power bank station business logic and profitability.

Scalable operations: With standardized operational procedures and equipment, the phone charging locker business is easy to replicate and expand rapidly. Investors can start with pilot projects, and after success, quickly scale to new regions or scenarios to achieve exponential growth.

Stable cash flow: Continuous charging demand from users creates sustainable passive income. Combined with efficient operations, phone charging vending machine projects can achieve annual returns exceeding 300%, providing investors with steady wealth growth. (For detailed case studies, please click the link.)

Conclusion

Shared power bank rental stations generate profits through multiple channels, including time-based rental fees, advertising income, deposits, value-added services, and product sales. Rental income helps investors cover operating costs and achieve quick profitability. By partnering with high-traffic locations and displaying brand advertisements on the equipment, investors can increase advertising revenue.

Offering membership systems and local service integrations increases income from value-added services. Rental deposits create liquidity, bringing short-term investment income. Product sales, such as accessories, further diversify revenue streams.

The frequent usage, large-scale deployment, and refined management of charging station power banks build economies of scale for investors, maximizing overall benefits. The more mobile charging stations are deployed, the higher the usage rate and the lower the unit cost.

The diversified profit model of phone charging stations helps investors achieve rapid returns at premium locations. The standardized operational model allows the mobile phone power bank business to be quickly replicated and expanded, while high market demand ensures continuous passive income and high return on investment for investors.

October 12, 2025

How can Shared MiFi Build a Scalable Business Model?

How can Shared MiFi Build a Scalable Business Model?

Why is the united states an ideal market for deploying mobile phone charging stations?

Why is the united states an ideal market for deploying mobile phone charging stations?

Why can deploying rental power banks in airports generate high profitability? What are the key advantages?

Why can deploying rental power banks in airports generate high profitability? What are the key advantages?

Looking for a hassle-free investment option? Discover the one-stop solution offered by mobile charging station manufacturers.

Looking for a hassle-free investment option? Discover the one-stop solution offered by mobile charging station manufacturers.

Why does deploying shared power banks at music festivals help investors rapidly increase cash flow?

Why does deploying shared power banks at music festivals help investors rapidly increase cash flow?

Ready to conquer the outdoor market? Why is the 48-slot waterproof power bank vending machine the key to investor success?

Ready to conquer the outdoor market? Why is the 48-slot waterproof power bank vending machine the key to investor success?